Author:

Aldi Haryopratomo,

Senior Fellow at IBC Institute

15 January 2024

To hit 8% GDP growth, Indonesia’s firms need to start thinking globally. It’s a simple fact, but one that seems to have gotten lost. Recently, a friend who works in semiconductors in Germany asked me a question that hit hard: Why did Indonesia lose out to Cambodia, of all places, in attracting semiconductor investments away from China? Cambodia, with less experience, weaker infrastructure, and smaller scale, somehow outcompeted us. This is not just an isolated case— Indonesia is falling behind to countries like Vietnam and Thailand across multiple sectors.

Take Vietnam, for example. It’s become the prime destination for companies following the “China Plus One” strategy, drawing manufacturing investments from global giants like Samsung and LG. This success didn’t happen by chance—Vietnam has pursued policies that make it attractive for foreign firms to relocate there. Meanwhile, Thailand has leveraged its advanced infrastructure and skilled workforce to remain a global manufacturing hub. So, why is Indonesia losing out? The reasons are clear: regulatory hurdles, low labor productivity, massive infrastructure gaps, and an over-reliance on a small group of large firms that dominate the market.

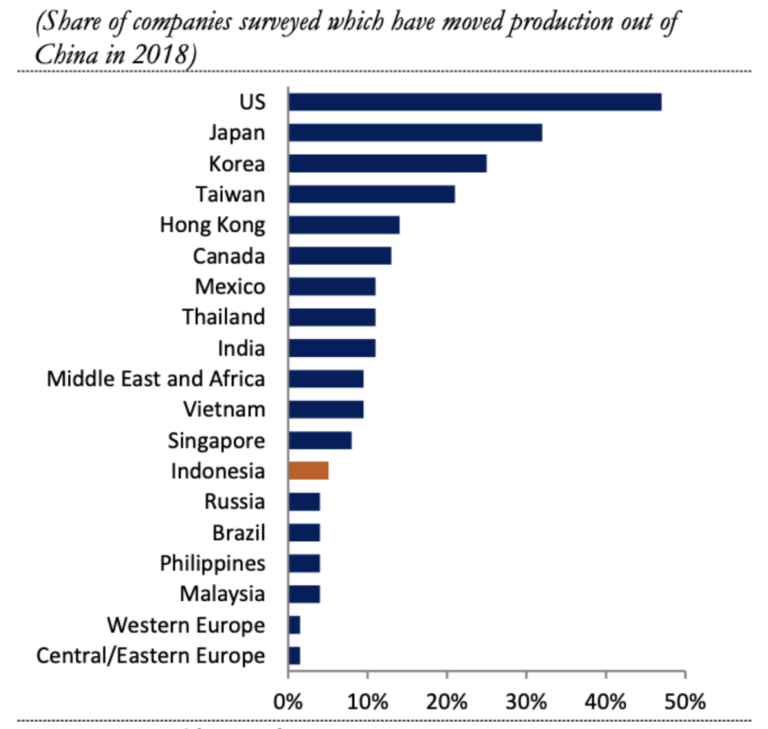

Firms are moving production out of China, but not to Indonesia

Source: UBS Evidence Lab

A Bureaucratic Nightmare: Twice the Time, Twice the Cost

The first issue is one we’re all too familiar with—Indonesia’s bureaucracy. It’s no secret that navigating the regulatory landscape here is time-consuming and expensive. According to a recent study by the World Bank, senior managers in Indonesian firms spend about 20% of their time dealing with government regulations. In comparison, Vietnam’s senior managers spend just 10% of their time on compliance, and Thailand’s figure is even lower (World Bank, 2019).

This additional bureaucratic burden means businesses in Indonesia spend more time and money on compliance instead of innovation and growth. Worse, companies often face unpredictable regulatory changes, making long-term planning difficult. Vietnam, by contrast, has worked hard to create a stable regulatory environment that fosters business confidence and encourages investment (World Bank, 2019).

Labor Productivity: Cheap Labor, but at What Cost?

The second challenge is labor productivity. While Indonesia’s wages are lower than those in many competing nations, its workers are far less productive. On average, Indonesia’s labor productivity is about 30% lower than Vietnam’s and 50% lower than Malaysia’s (World Bank, 2024).

This discrepancy makes Indonesia less attractive to manufacturers looking to shift operations from China. While labor may be cheaper, the longer time required to complete tasks can wipe out any savings. Vietnam has not only invested in higher labor productivity but has also developed better-trained workers in critical sectors like electronics, making it a magnet for high-tech manufacturing (World Bank, 2024).

The Infrastructure Gap: A $1.5 Trillion Problem

Indonesia’s infrastructure gap is another major barrier. According to a World Bank report, Indonesia faces a $1.5 trillion infrastructure gap (World Bank, 2019). Public capital stock per capita is 2.5 times lower than that of the average emerging economy, and this underinvestment affects businesses directly. Shipping goods in and out of Indonesia is both costly and slow, with logistics costs accounting for 24% of GDP, compared to just 13% in Thailand (World Bank, 2019).

Vietnam, on the other hand, has aggressively upgraded its infrastructure—ports, roads, and digital connectivity—making it easier and cheaper for manufacturers to move products. This advantage has allowed Vietnam to attract global manufacturers who are moving out of China, while Indonesia’s inefficient infrastructure has held it back (World Bank, 2019).

Need to Strenghen Collaboration Between Major and Small Businesses

A new report by the IFC shows that a smaller proportion of Indonesian firms hold a large share of total revenue than in other economies like the Philippines. The top 5% of Indonesia’s large manufacture companies are dominating the revenue share within the market while most enterprises remain small and less productive. To address this issues, large businesses should grow through improving their productivity that generate multiplier effect across the economic, such as creating better jobs, strengthening supply chain connections, fostering innovation, and producing other positive spillover effects (World Bank, 2024).

Large firms can play a pivotal role in driving economic growth by fostering collaboration between big enterprises and micro, small, and medium enterprises (MSMEs) while ensuring fair competition within the market. Such collaboration can strengthen the foundations of Indonesia’s economy, as MSMEs contribute 60.51% to the national GDP. Supporting smaller and medium- sized enterprises alongside major firms can further boost competitiveness by stimulating the growth of the manufacturing sector, ultimately contributing to the achievement of national welfare.

Furthermore, these changes could also attract increased investment in manufacturing to Indonesia, particularly as companies seek to relocate production from China. According to IFC report, while global firms are moving manufacturing out of China, Indonesia is not the top destination. Vietnam, Thailand, and even Cambodia have attracted more of these shifts, reinforcing the point that Indonesia is missing out on a golden opportunity to capture global manufacturing business (World Bank, 2024).

Concentrated Economic Power: A Small Group of Firms Control the Market

Adding to Indonesia’s challenges is the skewed distribution of economic power. A new report by the IFC shows that a smaller proportion of Indonesian firms control a larger share of total revenue than in other economies like the Philippines. In Indonesia, the top 5% of large firms have dominated sales for the past 31 years (World Bank, 2024).

This high concentration of market power could have profound implications. The dominance of a few large firms may stifle competition, reduce innovation, and ultimately hinder the broader economy’s growth potential. When economic power is concentrated in the hands of a small group, smaller and medium-sized firms struggle to compete, which could explain why Indonesia’s manufacturing sector is not as vibrant or innovative as its peers.

This pattern is reflected in manufacturing shifts as well. According to a chart in the IFC report, while global firms are moving manufacturing out of China, Indonesia is not the top destination. Vietnam, Thailand, and even Cambodia have attracted more of these shifts, reinforcing the point that Indonesia is missing out on a golden opportunity to capture global manufacturing business (World Bank, 2024).

Why Are Indonesian Firms Stuck at Home?

So why do so many Indonesian firms remain focused on the domestic market while their peers in Southeast Asia are expanding globally? One major reason is Indonesia’s over-reliance on its natural resources. The country’s abundance in commodities like coal and palm oil has driven a growth model centered on exporting raw materials rather than higher-value products. As a result, firms lack the incentive to innovate or explore international markets when the domestic demand for commodities is strong.

Moreover, Indonesia’s large domestic economy, with over 270 million consumers, provides businesses with little motivation to go global (World Bank, 2019). Many firms choose to focus on local demand rather than dealing with the complexities of international trade. However, this inward-looking approach limits growth potential and leaves Indonesia vulnerable to fluctuations in global commodity prices.

Time for Bold Reforms

If Indonesia is serious about competing globally, it needs to tackle these barriers head-on. First, regulatory reforms are essential. Vietnam’s ability to attract foreign investment is largely due to its predictable and business-friendly regulatory environment. Indonesia can follow this model by simplifying its compliance procedures and reducing bureaucratic delays.

Second, boosting labor productivity should be a national priority. Investments in education and vocational training will be key to creating a workforce that meets the demands of high-tech industries. Without a skilled labor force, Indonesia will continue to lose out to countries like Vietnam and Thailand.

Finally, Indonesia must address its infrastructure gap urgently. Vietnam’s infrastructure investments have helped it become a major player in global trade. Indonesia must prioritize infrastructure improvements, reducing transportation costs and increasing the speed at which goods can move in and out of the country.

Conclusion: It’s Time to Compete

Indonesia has the potential to be a significant player in the global economy, but it won’t get there without major reforms. We can no longer afford to be complacent while countries like Vietnam and Thailand capture the investments that should be coming to us. By reforming regulations, boosting productivity, and closing the infrastructure gap, Indonesia can start winning in the global trade game. The time to act is now—before we fall even further behind.